When is the right time to get into real estate? You need to know about real estate prices and rental market trends.

Many friends have been asking when is the right time to get into real estate (whether it’s residential or commercial). Many “experts” have been making various “divine predictions” since asset prices soared in 2020. In 2020, they predicted a market crash in 2021, but in reality, the market continued to rise. Then, they predicted a crash in 2022 after the Fed raised interest rates, and while there were some adjustments in different regions, the market didn’t crash. Next, they predicted a crash in 2023, and now, well into 2023, the market still hasn’t crashed, and prices have been slowly rising again since the beginning of the year.

These online “divine predictions” can continue until one day when the market does eventually crash, and they can claim they were right. However, regardless of what predictions people look at, the ultimate goal is to adjust their investment decisions based on an understanding of market dynamics and trends. When it comes to analysis and forecasting, ACMG Capital has always used objective big data analysis methods to help make rational judgments, without blindly believing in any so-called “divine predictions.”

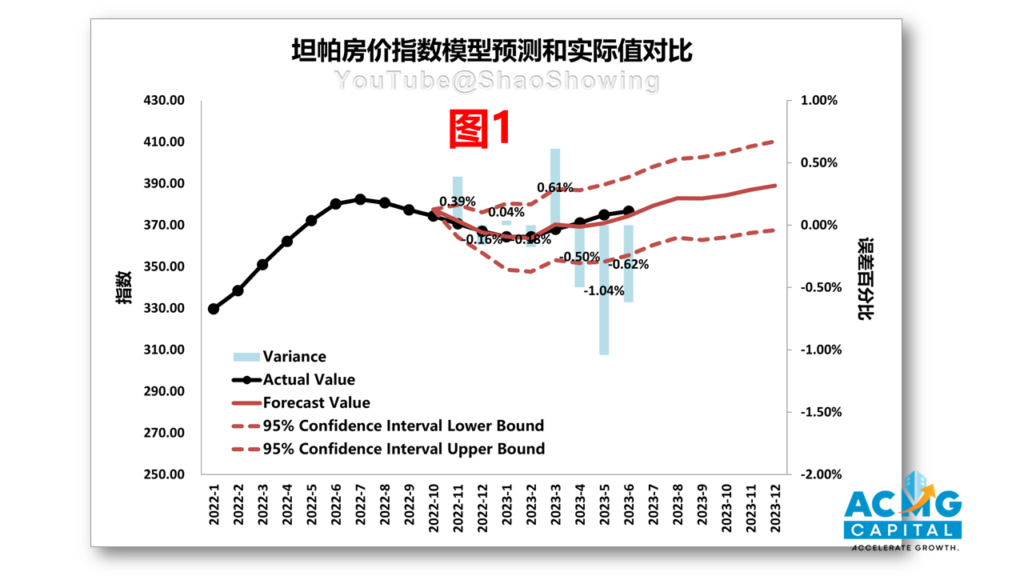

Towards the end of 2022, we created a housing price index prediction model to forecast the trends in Tampa Bay for 2023 and 2024. This prediction model considered multiple important factors that influence housing prices. Now, let’s validate it. Based on the existing real value data, within the framework of the optimistic scenario simulated by the model, the prediction model’s error accuracy percentage is within 2%, as shown in Figure 1. What does this mean? In simple terms, it means that the model has been very accurate in its predictions so far! Not only are the real values of the housing price index within the predicted range, but the curve of the predicted median (i.e., the general forecast) and the real values practically overlap. It’s evident that after a winter adjustment, housing prices have been trending upward since the beginning of the year.

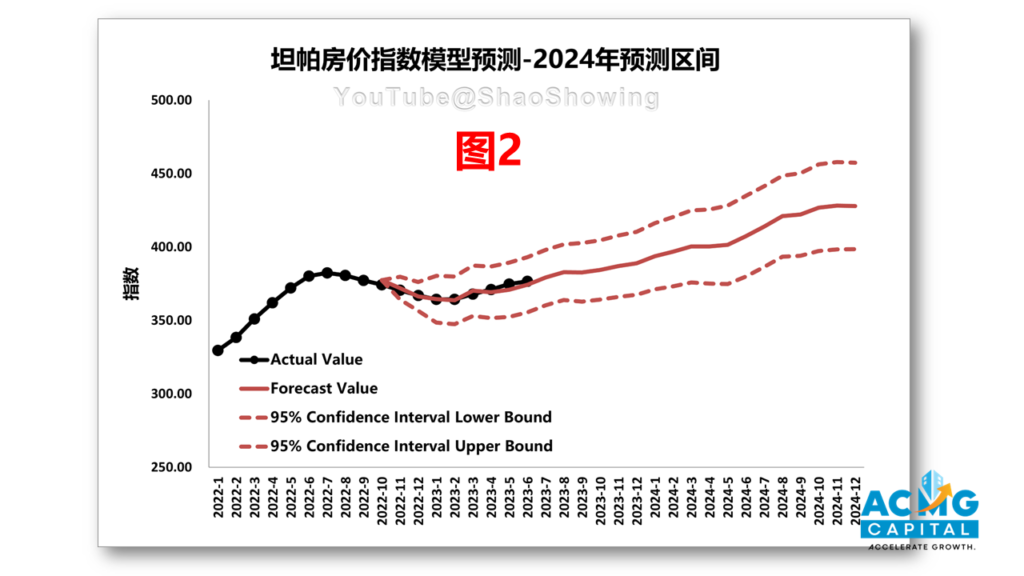

According to this prediction, in an optimistic scenario (assuming no major macroeconomic changes), housing prices in the remaining time of 2023 and 2024 will continue to rise slowly at a normal pace, as shown in Figure 2. Here, “normal pace” refers to the growth rate before the pandemic, or in other words, the rate during non-pandemic periods. So, for those “experts” who want to “time the market,” they have already missed the winter adjustment phase (often referred to as the bottom-buying opportunity). According to the predicted range provided by the model, compared to the middle of 2023, the range of housing price index changes by the end of 2023 is between -2% and 9%, with a midpoint of 3%, which means an average increase of around 3%. By the end of 2024, the housing price index change ranges from 6% to 21%, with a midpoint of around 13%. It’s worth emphasizing that these predictions are made within the framework of an optimistic scenario compared to the middle of 2023. This level of predicted increase is actually quite high; in normal years before the pandemic, the average annual increase was about 5%. Lao Shao feels that the 2024 forecast range is somewhat aggressive, so depending on the Federal Reserve’s interest rate hikes, it may need to be updated at the end of this year. The pessimistic scenario, which involves major macroeconomic changes like a severe economic recession, would result in a different prediction curve. You can find more information about this model’s predictions on Lao Shao’s viewing channel.

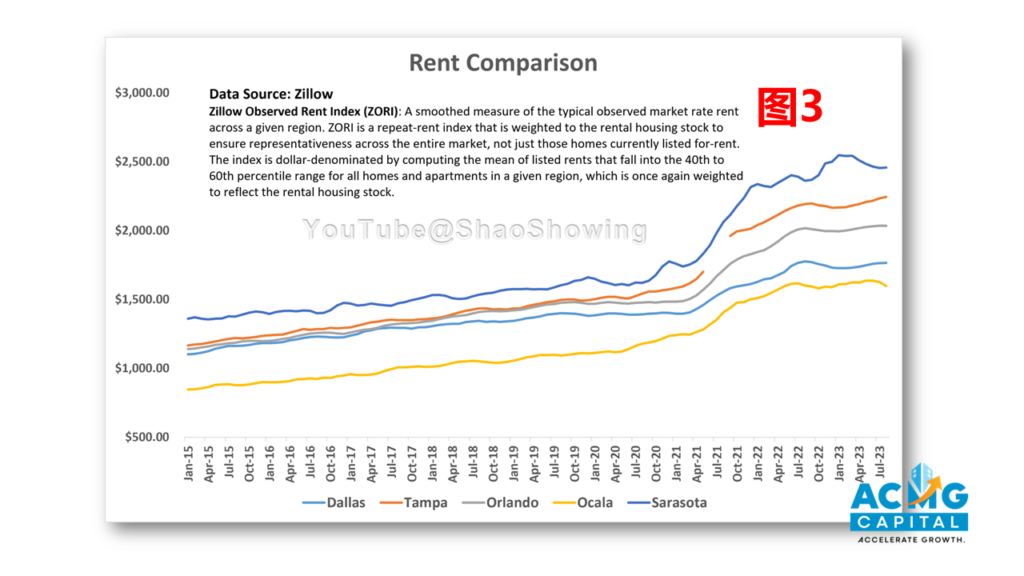

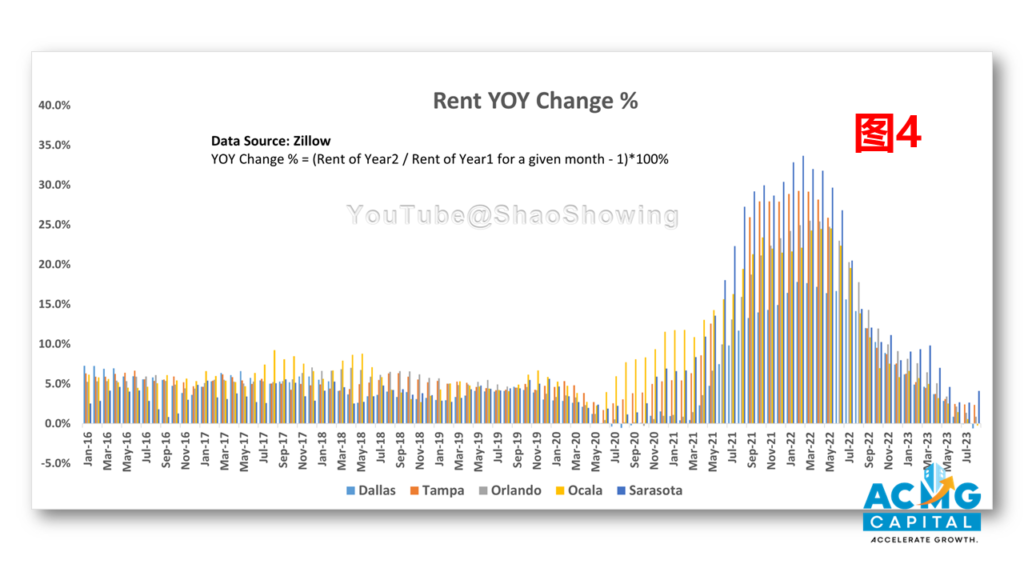

What about the current market conditions and future trends in the rental market (single-family and multifamily), especially regarding rental increases, which is a concern for investors? Since the Fed raised interest rates and there has been an increase in the supply of rental units since last year, many areas in the Sunshine Belt have also seen rental adjustments, as analyzed in previous videos on Lao Shao’s viewing channel. Here, let’s take a look at several markets that our ACMG Capital team is monitoring: Dallas, Tampa, Orlando & Central Florida, Ocala, and Sarasota. Most of these are thriving markets, with long-term stable growth trends, while Ocala is considered an emerging market with huge potential but relatively higher risk.

As evident from the rental rate comparison in Figure 3, these regions saw significant rental increases during the COVID period, but after the interest rate hikes, there were adjustments, meaning rental decreases, with varying degrees of adjustment in each region. Are these adjustments complete, or will they continue to decrease? Let’s look at Figure 4, which shows the year-over-year trend in rental rate changes. Based on the slope of this curve, intuitively speaking, the overall market increases in these regions are not likely to be significant in the coming year; they may remain flat, conservatively estimated to fluctuate around 0% (until the adjustments return to a normal market state, where average annual increases of 3%-5% can be expected). Conservative predictions are important because for investments, especially in large apartment complexes, rental growth forecasts can have a significant impact on underwriting. Overly optimistic predictions can make the overall return rate look too good to be true, potentially leading to incorrect investment decisions. Note that these predictions are at the overall market level. A significant portion of how much rent can increase for an apartment building depends on how much value the project team can add through management, i.e., adding value. So, from an investment perspective, the increase in rent for a specific project can be broken down as follows: x% + y%. Where x% is the market-level increase, and y% is the increase brought by the project team’s operation. The greater the project team’s management ability, the easier it is for y% to be larger. Of course, these market-level predictions are just simple intuitive estimates. Like the sales market, there are many factors that influence the rental market, and different factors working together on rents can yield different predictions. For those interested, you can have a detailed discussion with the ACMG Capital team.

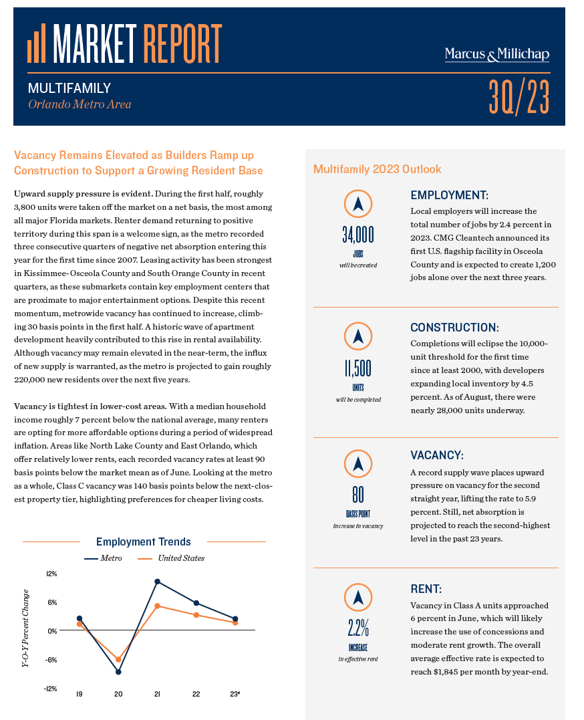

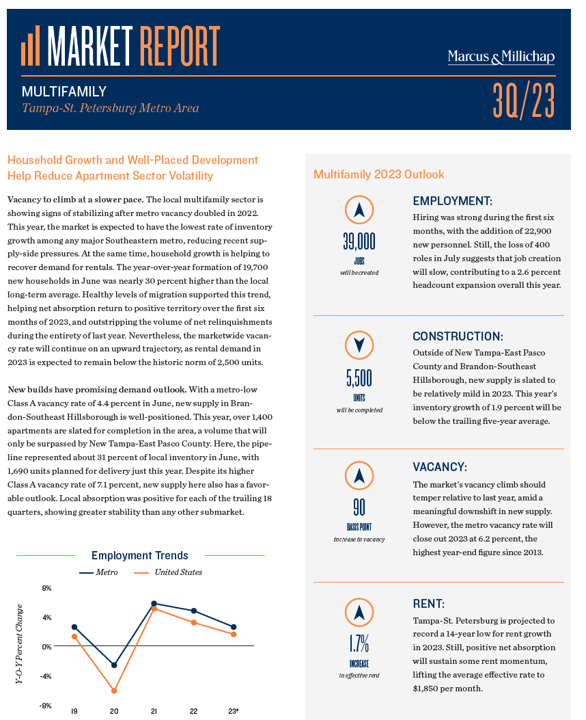

Let’s take a look at how the commercial real estate company Marcus & Millichap summarizes the apartment market in Tampa and Orlando for the third quarter of 2023.

Tampa: Reasonable Growth Helps Reduce Apartment Market Volatility

Slowly Rising Vacancy Rates: After doubling throughout the metro area in 2022, local apartment markets in Tampa are showing signs of stability. Tampa is expected to have the lowest apartment inventory growth among major Southeastern cities this year, easing the pressure from recent increases in rental supply. Meanwhile, growth in the local household size is contributing to the recovery of rental demand. In June, 19,700 new households were formed, nearly 30% higher than the local long-term average. Healthy population inflows support this trend, helping net demand for the first half of 2023 return to positive territory, exceeding the net abandonment for the entire previous year. Nevertheless, the overall market vacancy rate is expected to continue to rise as rental demand in 2023 is expected to be lower than the historical level of 2,500 units.

Optimistic Outlook for New Apartment Demand: In June, the vacancy rate for Class A apartments in the Brandon-Southeast Hillsborough area was only 4%, the lowest in the metro area. This year, the region plans to complete over 1,400 apartments, second only to New Tampa-East Pasco County. Here, the 1,690 units planned for delivery this year account for approximately 31% of the local inventory. Although the vacancy rate for Class A apartments is higher at 7.1%, the new supply here also has good prospects. For the past 18 quarters, local absorption has remained positive, showing greater stability than any other submarket.

In summary, the outlook for the Tampa Bay apartment real estate market in 2023 is positive, but the overall market vacancy rate will continue to rise.

Orlando: High Vacancy Rates Persist as Developers Ramp Up Housing Population Growth

Significant Supply Pressure: In the first half of the year, approximately 3,800 units were withdrawn from the market, the most among all major metropolitan markets in Florida. The return of tenant demand during this period is a positive sign, as the Orlando metro rental market has shown a trend of oversupply (negative net absorption) for three consecutive quarters, a phenomenon not seen since 2007. In recent quarters, rental markets in Kissimmee-Osceola and South Orange counties have been the most active, as these submarkets are close to key commercial and entertainment centers. However, the overall metro area vacancy rate continues to rise, increasing by 30% in the first half of 2023. Historically, large-scale apartment development projects have been a significant reason for the increase in supply. While vacancy rates may still be relatively high in the short term, the new units make sense as the Orlando metro area is expected to add approximately 220,000 new residents over the next five years (so the new supply units are expected to be gradually absorbed by the market).

Highest Vacancy Rates in Low-Cost Areas: During inflationary periods, many tenants opt for more affordable housing due to median household incomes being approximately 7% lower than the national average. Areas with relatively lower rents, such as North Lake County and East Orlando, had vacancy rates at least 90 basis points lower than the market average as of June. From a metro-wide perspective, the vacancy rate for Class C apartments is 140 basis points lower than the next closest level of apartment property, highlighting the preference for lower living costs.

Please note that these summaries are based on the data and analysis provided by Marcus & Millichap for the third quarter of 2023 in the Tampa and Orlando markets. For the original reports, you can click on the links for the Tampa Bay 2023 Q3 Apartment Market Report and the Orlando 2023 Q3 Apartment Market Report.

Alright, we’ve analyzed the recent market conditions, and let’s revisit the question posed at the beginning of the article: “When is the right time to get in?” By now, I believe those who truly understand the U.S. real estate market should have an answer: “The best time was in the past, the second best time is now.” The moment you find a deal that satisfies you is the best time. Real estate investment is a long-term game, not a short-term bet. When you carefully analyze and select the market you want to invest in, stay vigilant, and focus on deals, you’ll realize that there are good deals at any time and in any market. Truly successful investors focus on deals and persistently invest. They don’t try to time the market or wait for a so-called crash because that’s akin to gambling. Events like the 2008 crisis are low-probability events, and putting all your bets on a low-probability event is a high-risk strategy.

A market is vast, and if you try to catch everything, you’ll find that you can’t catch anything. Moreover, lazily waiting for others to provide answers while not actively seeking deals comes with a significant opportunity cost. In a large market, plan your business plan, investment goals, risk control strategies, and methods. Set your criteria, and you’ll have your own framework, making execution much easier. For example, our mentor Sumrok at ACMG Capital has been investing in large apartment complexes for 20 years, through economic upturns, downturns, and peaks, and has been very successful.

I hope this article has been helpful to those looking to invest in U.S. real estate.