The Federal Reserve has finally brought some good news to the real estate market—a 50 basis point rate cut! This is the first significant rate reduction in nearly four years. In addition, the Fed could expect to cut rates by another 50 basis points by the end of 2024, followed by a 100-basis point cut in 2025 and another 50-basis point cut in 2026. What could these potential actions signal?

While this rate cut aligns with Wall Street’s predictions, there are differing opinions in the market. The real estate sector is mostly celebrating. Many homebuyers, who have been holding off for two years, are finally seeing some relief. Major homebuilders’ stocks surged in response. Many commercial real estate investors believe that the rate cuts will help reduce the pressure and risks on commercial properties, aiding the refinancing of distressed properties with maturing debt, and helping them weather the storm. However, some worry that the Fed’s move might indicate the economy is weaker than expected, perhaps already in recession. Others are even comparing this to the 2008 subprime crisis rate cuts, hinting that a major recession could be on the horizon. Some investors feel that such aggressive cuts could trigger a second wave of inflation. Claudia Sahm, the creator of the “Sahm Rule,” remarked that the “Fed’s 50 basis point cut was the right move.” In short, the market’s reaction to this meeting has been quite varied.

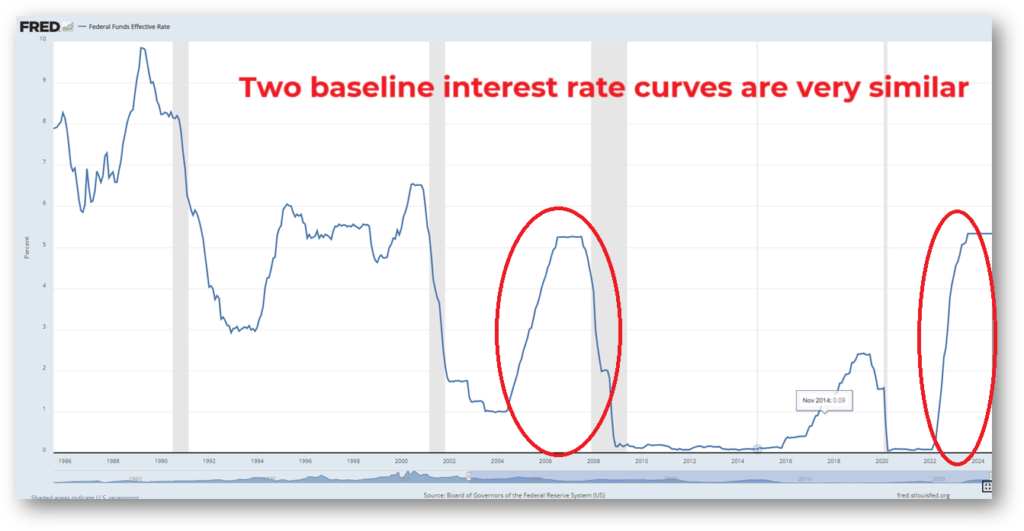

Let us share two thoughts based on historical data: one about whether we are heading into a recession, and another about the possibility of a second wave of inflation—two sides of the same coin. First, regarding a recession, I believe it’s unwise to directly compare these rate cuts with those during the 2008 subprime crisis. While the baseline interest rate curves over the last 30 years are indeed most similar in these two periods, the economic backgrounds are vastly different.

The 2008 recession was triggered by subprime mortgages. However, after learning from that crisis, Fannie Mae, Freddie Mac, and the banking system no longer engage in reckless lending. So, this significant rate cut doesn’t necessarily mean we’re in a recession. If the Fed’s rate cuts are preemptive, the chances of a recession are lower. Whether this rate cut is too late is still debatable, as employment is only slowing down for now. Claudia Sahm recently said this time is different.

Second, regarding inflation: the current core inflation rate is 3.2%, which is trending in the right direction. However, we’re still some way from the 2% target. If the Fed continues cutting rates, could it trigger a second wave of inflation? It’s hard to predict simply. Much of the current inflation is due to the money printed during the pandemic. The Fed’s use of quantitative easing is relatively new, dating back only to the 2008 subprime crisis. In total, they’ve employed it four times, with the most aggressive rounds happening during the 2008 crisis and the pandemic. However, it’s only this latest round during the pandemic that led to the highest inflation in 40 years. There are too few data

points to draw a clear pattern. But it’s true that there’s still a lot of money in the capital markets, and if rate cuts are swift and significant, a second wave of inflation can’t be ruled out. Intuitively, if the Fed doesn’t drop rates back to pandemic levels quickly, the chances of a second inflation spike are low. In short, the future of the economy and inflation remains uncertain, and the Fed could still make a misstep.

As a real estate investor, we’ll stick to what I’ve always said—there are always opportunities. Only those who take the initiative can seize them. By having a solid investment plan and good risk management, you might just be able to pick up some distressed properties at a bargain. Are you ready?